by Coreen Brent

Whether in work or personal life, many people place a certain importance on soft skills like leadership or communication. But the one skill that should never be overlooked is financial literacy.

Financial literacy is what compels us to save for retirement, invest in insurance, and avoid getting into debt. Unfortunately, CNBC reports that the average American today is around $38,000 in personal debt, and they’re digging themselves into a deeper hole every year. While this is undoubtedly caused by a number of factors, it can be helped with some basic money smarts.

Independence

Parents have their own strategies when raising their children to become independent adults, and part of it is teaching them the basics when it comes to personal finances. Whether it’s teaching them to save their allowance or how to invest their hard-earned money, being financially smart is going to help them survive in the real world and in this tough economy. After all, not everyone has free-flowing income — and even when you do, it doesn’t mean you’re excused from spending recklessly.

Take it one topic at a time

Financial literacy can be overwhelming, so it’s best to learn about it little by little. While you should have a basic understanding of personal finance as soon as possible, don’t make the mistake of getting into multiple topics at once. Instead, pick an area that is particularly relevant to you and work your way up from there. You can start with learning different budgeting strategies, or read about tax cuts that you may be eligible for. After, you can move on to more complex topics like investing in stocks or bonds.

Dynamic markets

Investors are well aware of how volatile and ever-changing the global market can be. Between the number of players, technological advances, eTrading, and many more factors — there are lots of things to consider when making your investments. If you want to reap more profits, you have to do your research on where to put your money. You can’t buy into trends like Bitcoin just because it’s popular, if you don’t actually know much about it as you might just end up losing a significant amount of money.

Alternative retirement plans

In years gone by, people depended on their pension to fund the majority of their retirement years. But since the pensioners themselves were rarely involved in the process, it put them at a disadvantage of not knowing the status of their funding, or having their investments withheld altogether. Today US employees are being given the option to participate in 401k plans, which is a way for them to make their own retirement investments. It may sound risky, but again, it goes back to the need to educate yourself on the different strategies and which one works best for you.

Draining government aid

Another major source of retirement income is Social Security. However, the amount paid by Social Security is not enough to live off alone, and it may not be available at all in the future. According to the latest reports on ABC News, the Social Security Board of Trustees warns that the Social Security Trust Fund could be completely depleted by 2035. As early as now, people are making Social Security their back-up plan while they look for other avenues to get the retirement money they need.

Consult the experts

For those who are unfamiliar with the world of finance, you may have an image of financial experts as strictly corporate professionals who speak an entirely different language. In reality, they aren’t quite as intimidating. In fact, Maryville University states that today’s finance professionals go beyond dealing with monetary concerns, and also have a strong skill-set dedicated to business and strategies to improve overall financial well-being. On top of this, they are also well-trained in other skills like marketing, analysis, and portfolio management. This ensures you get a holistic approach to financial planning assistance, so don’t be afraid to seek one and build a lasting relationship with them for your financial woes.

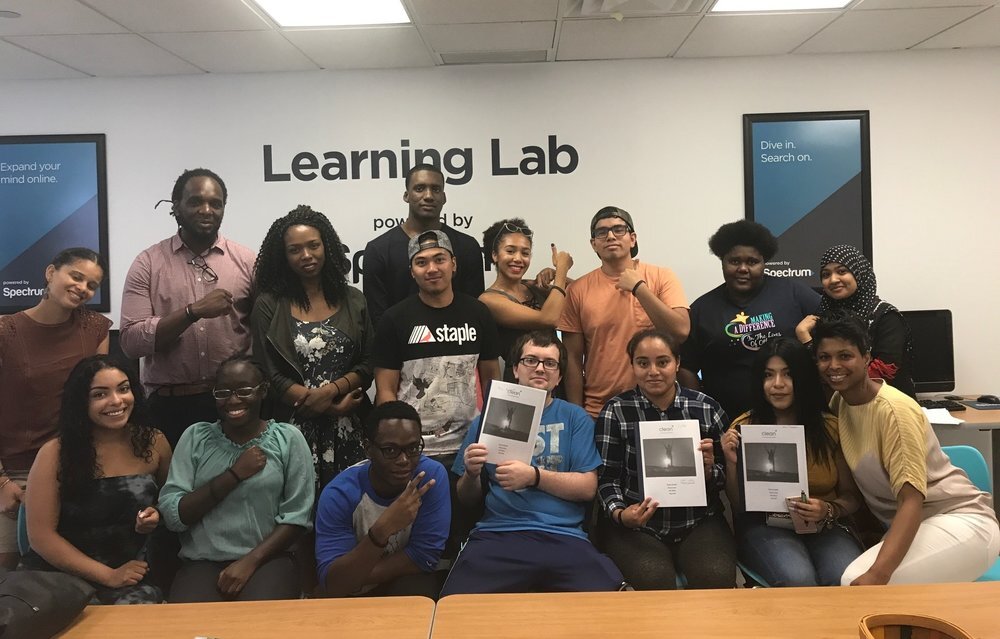

Attend some workshops

Financial literacy may not be something that’s taught in most schools, but workshops are the closest thing you can get to it. Here at Financially CLEAN we offer a fun and interactive 12-week workshop for students K-12 to college, in order to teach them how to manage, grow, and protect their money based on the five principles of CLEAN: Credit, “Learn to live without”, Education, Attention to detail, and “No shame in your game”.

Learning how to “finance” is never easy. But once you get the hang of it, you’ll be saving yourself a lot issues down the line. And you’ll thank yourself later.